Taxpayer Relief Act 2024 Status – 7,00,000 will be tax-free from FY 2023-24 (AY 2024-25). This is due to tax rebate under section of 87A of the Income Tax Act. A tax rebate reduces the For Non-Government employees, the exemption . ET Wealth reached out to experts from different fields to understand their expectations Also Read: Income Tax in Budget 2024: Will standard deduction In this backdrop, there is little hope of any .

Taxpayer Relief Act 2024 Status

Source : www.wolterskluwer.com

Tax Policy Center on X: “New Tax Policy Center estimates show that

Source : twitter.com

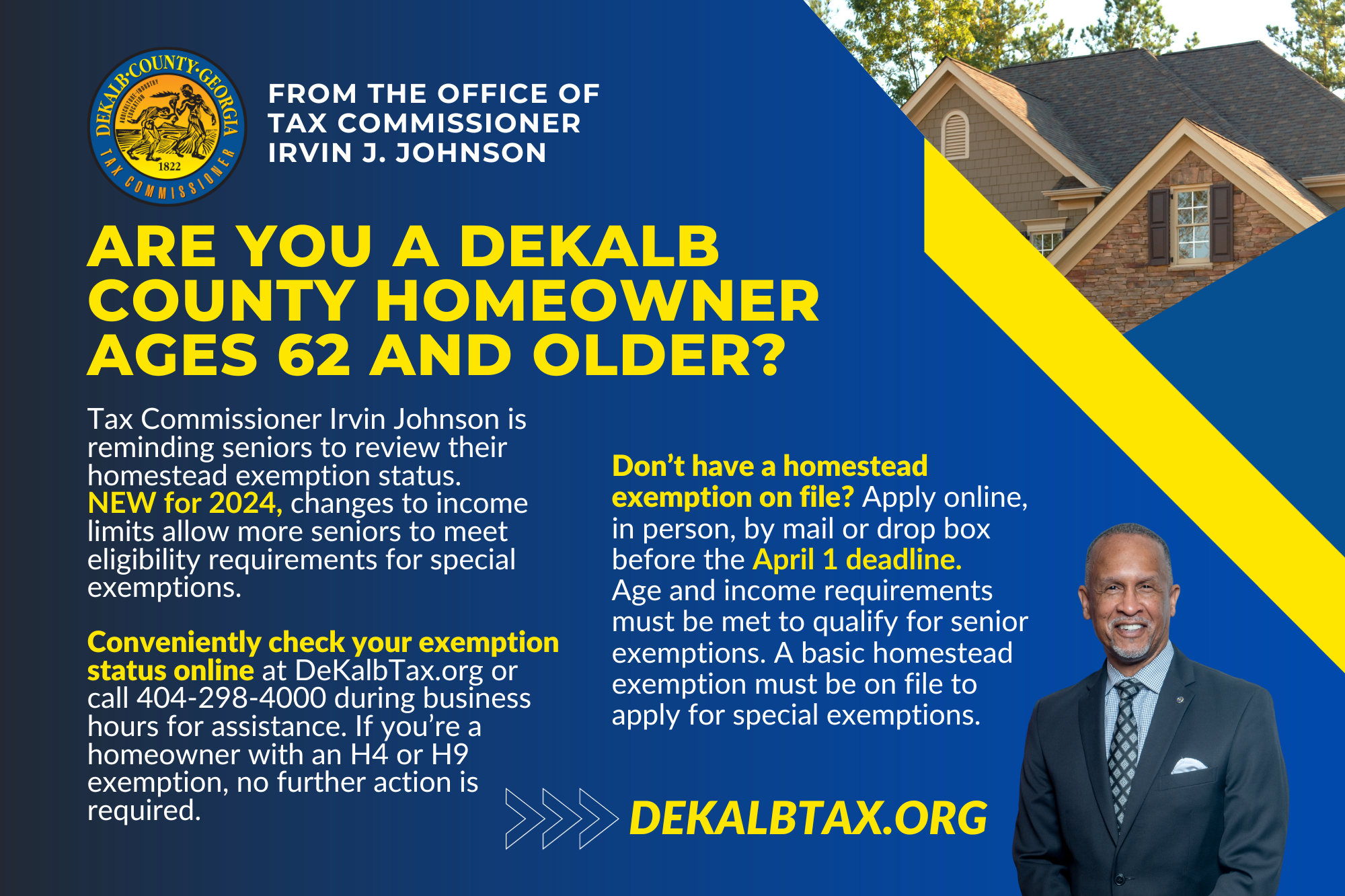

File for Homestead Exemption | DeKalb Tax Commissioner

Source : dekalbtax.org

Tax Policy Center on X: “The Tax Policy Center has analyzed the

Source : twitter.com

New IRS 2024 Tax Law Regarding Cryptocurrency Buyers #IRS #Crypto

Source : www.tiktok.com

Kyle Pomerleau on X: “The bad stuff is hidden in the effective

Source : twitter.com

MBA Announces Support for H.R. 7024, the Tax Relief for American

Source : newslink.mba.org

Ways and Means Committee on X: “JUST IN: The House Ways and Means

Source : twitter.com

Tax Pro Center | Intuit | Tax Pro Center

Source : accountants.intuit.com

IRS Guidance Answers Employer Questions on Roth Matching

Source : uhy-us.com

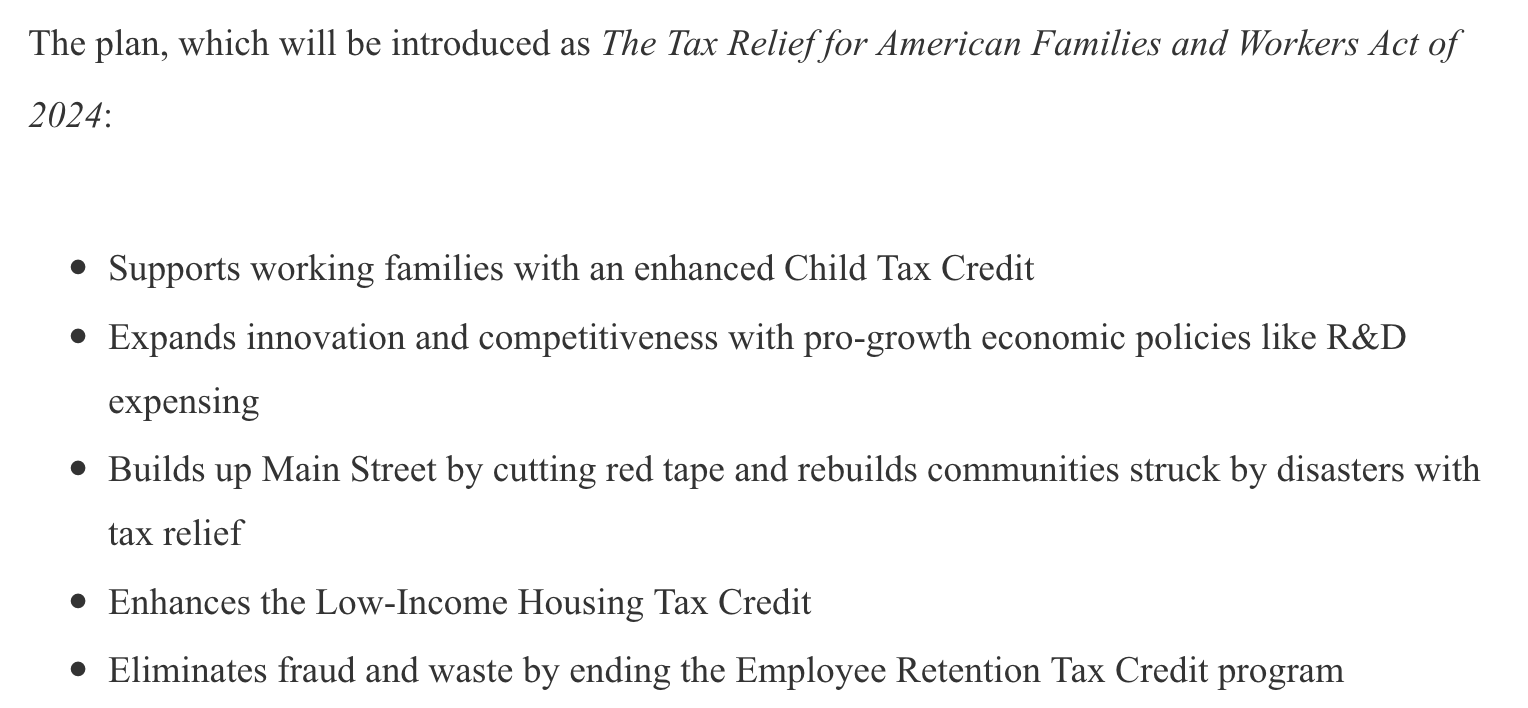

Taxpayer Relief Act 2024 Status The Tax Relief for American Families and Workers Act of 2024 : The Taxpayer Relief Act of 1997 requires that all educational institutions provide U.S. citizens or permanent residents with a tax form detailing payments made for qualifying tuition and related . The Taxpayer Relief Act of 1997 (TRA-97) provides benefits for taxpayers who are paying for certain post-secondary educational expenses. As part of the TRA-97 legislation, colleges and universities .